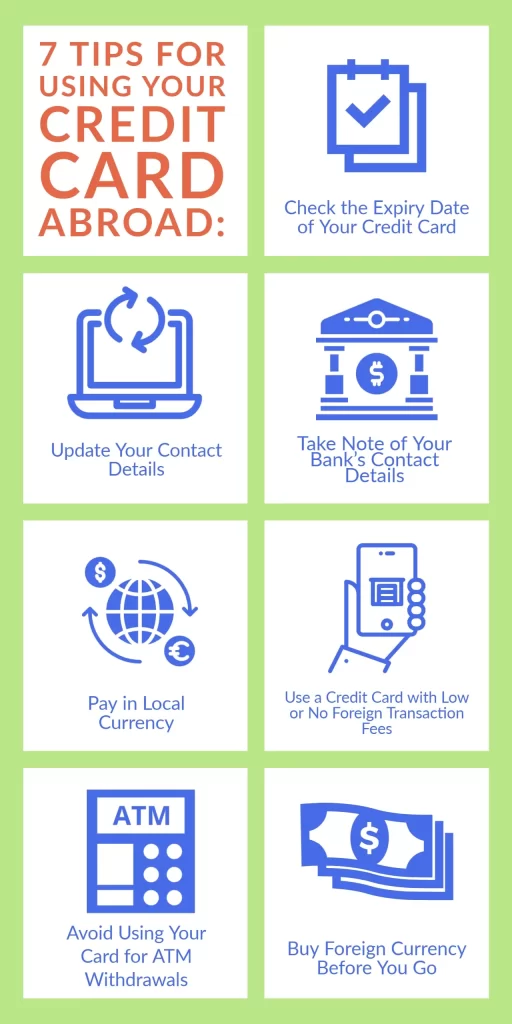

“7 Tips for Using Your Credit Card Abroad: How to Spend Safely and Avoid Extra Charges.”

- By Irmin Corona

- One Comment

- English

- Read Time 2.30 min

Traveling abroad is exciting, but it can also be stressful, especially when it comes to managing your finances. A credit card is a convenient way to pay for things abroad. Still, it can also come with additional charges, especially when you withdraw cash. In this article, I’ll give you 7 tips for using your credit card abroad to help you spend safely, avoid extra charges, and stay secure.

Table of Contents

Check the Expiry Date of Your Credit Card

The first thing you should do before traveling abroad is double-checking your credit card’s expiry date. Even when your card isn’t close to its expiration date, it’s wise to carry an alternative payment method, like a debit or a second credit card. It’s essential to ensure your credit card works during your trip to avoid being without access to your funds.

Update Your Contact Details

You must update your bank with your current contact information before you travel. This way, your bank can contact you if they notice any unusual spending on your account.

Take Note of Your Bank's Contact Details

It’s essential to be prepared for unexpected situations while traveling. To stay on top of things, write down your bank’s emergency phone number if your credit card is lost or stolen. Additionally, setting up online and mobile banking can help you track your spending and quickly block or cancel your card if needed.

Pay in Local Currency

Using your credit card abroad may come with additional fees.

Consider paying in the local currency instead of your currency to avoid these charges and get a better exchange rate. Keep an eye out for this option when using your credit card abroad.

Use a Credit Card with Low or No Foreign Transaction Fees

If you’re a frequent traveler, a credit card offering low or no foreign transaction fees is worth considering. This way, you can save money on costs when using your credit card overseas, making your trips more budget-friendly.

I suggest trying the Wise debit card, which offers the most favorable exchange rates and transaction fees.

Avoid Using Your Card for ATM Withdrawals

Using your credit card to withdraw cash from many ATMs abroad is possible. However, it’s essential to remember the foreign transaction fees and currency conversion markups that may apply.

Non-own local currency transaction fees

You can use your credit card with any currency from any foreign country. Typically, the expenses incurred for this service are around 2-3% of the total purchase amount.

Cash withdrawal fees

In addition to the fee for foreign transactions, you may be subject to a 2-5% charge or a minimum of 3 USD for every cash withdrawal.

Exchange rate markups

Credit card companies may apply an undisclosed margin to the mid-market exchange rate when converting foreign currency, resulting in an overcharge. Be aware of this.

Interest charges

Credit card companies can charge high interest if you don’t pay your bank statement to minimize additional costs. It’s best to fully pay off your monthly bill to avoid high-interest rates.

Buy Foreign Currency Before You Go

Buying foreign currency using cash before you arrive at the airport is wise, as using credit and debit cards at ATMs may result in cash withdrawal fees. Moreover, airport exchange rates are typically less attractive than those available at currency exchange counters.

One Response